Expanding Outreach with Local Touch

Experience the world of simplified banking and exclusive benefits.

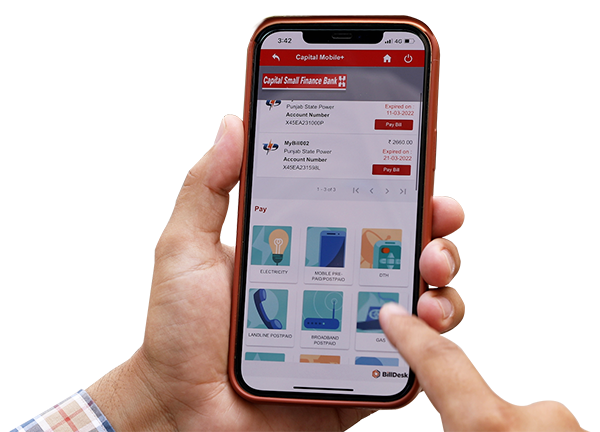

A branch-like experience with our Digital Banking solutions.

Expanding Outreach with Local Touch

One-Stop Financial Hub with Holistic suit of product offerings

Consistent track record of growth

Deeply entrenched physical branch network

Seamless Digital Banking

Secured and diversified advance portfolio

*Terms and Conditions Apply!